85% of top markets now use escrow security, up from 60% in 2023—see Alphabay. Select BTC for speed (e.g., Bohemia), XMR for privacy (e.g., Incognito), or USDT for cost (e.g., ASAP). XMR’s 40% adoption in 2025 cuts tracking risks—BTC’s blockchain exposed 15% of trades in 2024. Check onion links against trusted directories like dark.fail—30% of 2025 links are phishing traps. Cross-reference with PGP-signed mirrors on forums, and avoid clicking unverified URLs.

Bitcoin Darknet Marketplace Abacus Market Goes Dark, Exit Scam Suspected

Like DNMs, online pharmacies receive most of their revenues from larger drug resellers. While Mega’s inflows declined by more than 50% year-over-year (YoY), Kraken DNM’s rose nearly 68% YoY. Kraken DNM, which billed itself as Hydra’s Market’s successor, received $737 million on-chain in 2024. Blacksprut, which rose to prominence with Mega in the wake of Hydra’s 2022 sanctions designation, law enforcement seizure, and subsequent collapse, came in third with 13.6% less revenue YoY.

Bohemia’s 850+ vendors maintain its 22,000+ listings, rated 4.4/5 across 30,000+ reviews, with drugs (70%), digital goods (20%), and fraud tools (10%) as key offerings. Response times average 16 hours, with a 92% shipping reliability rate—disputes occur in 3% of transactions, resolved in 48 hours for 85% of cases, supported by a 92% escrow success rate. Vendors like “BohemianRx” and “DataVault” offer 96% reliability, though its BTC-only focus and smaller pool keep it behind multi-crypto markets like ASAP. Drughub Market grabs #3 in our 2025 darknet rankings, staking out a special spot as a pharma-focused trading hub in the anonymous scene.

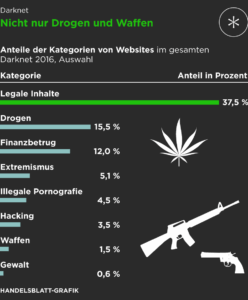

From items like drugs, fake ID cards, and hacked bank accounts to more complex offerings like human trafficking, these sites carry all the illegal activities you can think of. Although these marketplaces are continuously shut down by law enforcement agencies, they still work today. Interestingly, new sites get more hype, and it even becomes difficult to shut them down, as they have better security than the older ones. We use data of DWM transactions on the Bitcoin blockchain pre-processed by Chainalysis Inc. Although other coins are used, such as Monero recently, Bitcoin is still the mostly used in the ecosystem, being supported by more than 93% of markets7,9. The pre-processing relies on established state-of-the-art heuristics to cluster addresses into entities, such as cospending, intelligence-base, and behavioral clustering39,40,41,42.

Torrez Expands

Some of the markets shown in the second graph are more popular in some countries than others, but overall, the data shown below will be more relevant to investigators based in the U.S. and Western Europe. Although eight of the darknet markets active in 2018 closed in 2019, eight new ones opened, keeping the total number of active markets steady at 49. On average, each active market in 2019 collected more revenue than those active in any other year, apart from during the height of Silk Road’s heyday in 2012 and 2013. As we’ll examine in more detail later, it appears that when some markets close, others are able to pick up the slack and satisfy customer demand.

User Interface Upgrades

Due to its extensive inventory and reputation for reliability, Brian’s Club has maintained a significant presence on the dark web. Quality and validity of the data it provides justify its higher cost over other marketplaces. The platform’s popularity continues to grow, attracting both new and returning customers. Its focus on financial fraud and high-value transactions has attracted a dedicated user base, contributing to its growing reputation and market value.

Escrow Dominance

Then, between 2017 and 2018, there is a drastic structural change in the multiseller network structure due to operation Bayonet, after which the connections almost vanished. This change persists until the end of the observed period of the data set (also see Supplementary Information S4). In 2025, darknet marketplaces primarily accept Monero (XMR) and Bitcoin (BTC). Privacy-focused operators are shifting to Monero due to its default anonymity, compared to Bitcoin’s transparent ledger Darknet markets see BTC inflow drop to $2B.

- Funds are held until delivery, resolving 90%+ disputes within 48 hours, vs. 40% scam rates in direct deals.

- Clear compliance standards for crypto firms and financial institutions are crucial to balancing risk mitigation with industry innovation.

- Bitcoin continues to lead as the most widely accepted digital currency due to its high liquidity and global acceptance.

- And then there’s malware—click the wrong link or download the wrong file, and your device could get infected.

Power Your Insights With Data You Can Trust

At its peak, Hydra Market was the single largest darknet market as well as the largest marketplace for online narcotics in countries of the former Soviet Union. Unrivaled in its size, reach, and complexity, and vertically integrated network—along with its status as a crucial hub for illegal cryptocurrency cashout services—made it a significant player amongst darknet marketplaces. Its closure on April 5, 2022 created a seismic shift in the Russian-language darknet marketplace landscape. Darknet markets continue to show signs of recovery as their crypto revenue saw a rise in 2023 despite the sizable Hydra marketplace close in 2022. According to data published by blockchain forensics firm Chainalysis, fraud shops and darknet marketplaces saw their revenue increase to nearly $2 billion in 2023, up nearly 25% from figures for 2022.

TorZon Marketplace

Whether you’re trading on Abacus or Vice City, these answers provide clarity for 2025’s darknet ecosystem. What sets this guide apart is its depth—beyond just rankings, we’ve woven in historical angles, user thoughts, and hard numbers for a full picture of each market. Together, these ten markets handle over $50 million in monthly trades, showing their clout in the hidden economy. Keep reading to uncover the stories, stats, and tactics behind these top-tier trading hubs shaping the underground scene in 2025.

For example, in India, one of the most frequent listings is for generic medication, which mostly comes from the first vendor shown below. While the US market is best characterized by its diverse product offerings, other countries offer regional specialties. In Colombia, for instance, many of the vendor listings are for cocaine or Infrastructure-as-a-Service, as seen in the screenshot below. Below is a screenshot from the Abacus Market website showing the range of items it sells, with drugs and chemicals representing the overwhelming majority of its products. “Markets have sort of varying levels of sensitivity to fentanyl-related sales,” he said.

We’re talking about even early access to unreleased music, leaked TV episodes, concert footage, and even popular video games before they officially drop. As we mentioned earlier, not everything sold on dark web markets is illegal. As terrible as its reputation may be, some vendors sell legitimate goods or services. Some customers even use the dark web to make anonymous purchases, especially in areas where privacy is a huge concern. Exodus Marketplace started to become popular after the shutdown of Genesis Market, and it replaced it successfully. It claims to control more than 7,000 bots from 190+ countries, with data prices ranging from $3 to $10, based on the quality it offers.

Improved Security Protocols

In the end, he was sentenced to life in prison for running one of the largest and most scandalous dark web cases in history. This can include everything from full names, email logins, and passwords to credit card details, social security numbers, and bank account information. The cybercriminals trade even sensitive documents, such as medical records, passport information, and driver’s licenses.

Top 10 Darknet Markets 2025

The nodes of the S2S network are active sellers (i.e., sellers that are trading at the time) and two sellers are connected by an edge if at least one transaction was made between them during the considered snapshot period. Although the S2S network is composed only of U2U transactions, all categories of sellers (i.e, market-only, U2U-only, and market-U2U) are present in the S2S network. For instance, market-only sellers are entities classified as sellers only in markets, but that may promote U2U transactions with other sellers, hence being part of the S2S network. Therefore, the S2S network can be seen as a proxy for a distribution network of illegal products. To analyse the connectivity of the whole ecosystem, i.e., how markets are connected with each other, we consider sellers and buyers that are simultaneously active on multiple platforms. In particular, multihomers that are sellers in multiple markets are multisellers, and similarly for buyers we have the multibuyers.

Buyers send money to the marketplace, which in turn sends the money to the seller. Thus, further analyses in this direction have been hindered by the lack of heuristics able to identify these two key classes of actors in transaction networks and their roles in the structure and dynamics of the ecosystem. DWMs are also communication platforms, where users can meet and chat with other users either directly—using Whatsapp, phone, or email—or through specialised forums. We estimate that the trading volume of U2U pairs meeting on DWMs is increasing, reaching a peak in 2020 (during the COVID-19 pandemic). By contrast, trading volume on DWMs was negatively affected by COVID-19, mainly due to shipping delays37,38.